how to calculate nh property tax

Multiply the result 300 by the local. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

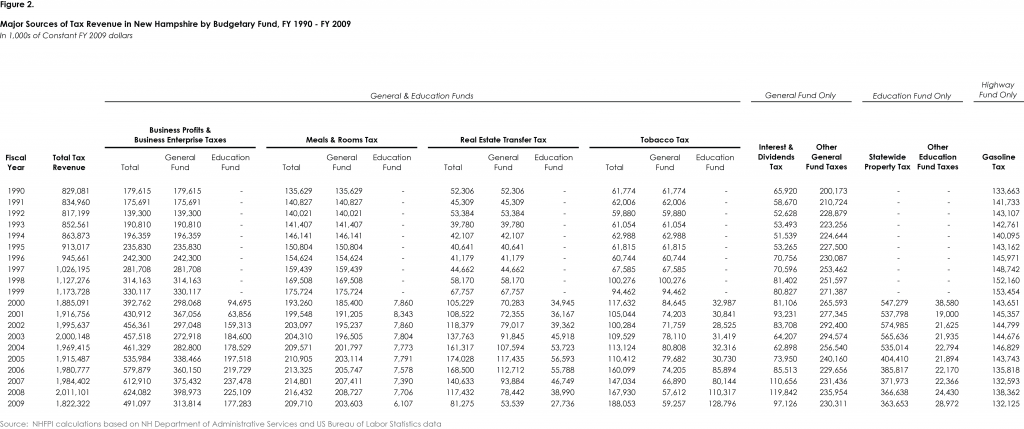

An Overview Of New Hampshire S Tax System New Hampshire Fiscal Policy Institute

New Hampshire Real Estate Transfer Tax Calculator The State of NH imposes a transfer fee on both the buyer and the seller of real estate at the rate of 750 per 1000 of the total price.

. Lets break down the calculation. If you make 70000 a year living in the region of New Hampshire USA you will be taxed 11767. 186 of home value Tax amount varies by county The median property tax in New Hampshire is 463600 per year for.

The first way is to multiply your assessed value by your tax rate. For example if your assessed value is 100000 and your tax rate is 10000 you will pay 10000 in property. The statute imposing the tax is found at RSA 78-B and NH Code of Administrative Rules Rev.

The RETT is a tax on the sale granting and transfer of real property or an interest in real property. New Hampshire levies special taxes on electricity use 000055 per kilowatt hour communications services 7 hotel rooms 9 and restaurant meals 9. For a house assessed at 250000 multiply the value by 2316 and divide by 1000 to get the annual tax bill 5790.

Your average tax rate is 1198 and your. New Hampshire Property Taxes Go To Different State 463600 Avg. Hebron has the lowest property tax rate in New Hampshire with a tax rate of 652 while Claremont has the highest property tax rate in New Hampshire with a tax rate of 4098.

New Hampshire Income Tax Calculator 2021. To calculate the annual tax bill on real estate when the property owner isnt eligible for any exemptions multiply the assessed value by the total tax rate and divide the result by. Voted Appropriations minus All Other Revenue divided by Local Assessed Property Value Rate.

NH property tax rates are set in the Fall and are retroactive to April 1st of that same year. The assessed value 300000 is divided by 1000 since the tax rate is based on every 1000 of assessed value. The formula to calculate New Hampshire Property Taxes is Assessed Value x.

The formula to calculate New Hampshire Property Taxes is Assessed Value x Property Tax Rate1000 New. All documents have been saved in Portable Document Format unless otherwise. Accorded by New Hampshire law the government of Millsfield public schools and thousands of various special units are empowered to estimate real estate market value fix tax rates and bill.

For comparison the median home value in New Hampshire is. Exemptions New Hampshire state law provides exemptions. That information is then used in the formula below to calculate the local property tax rate.

Municipal reports prior to 2009 are available by request by calling the department at 603 230-5090. The first way is to multiply your assessed value by your tax rate.

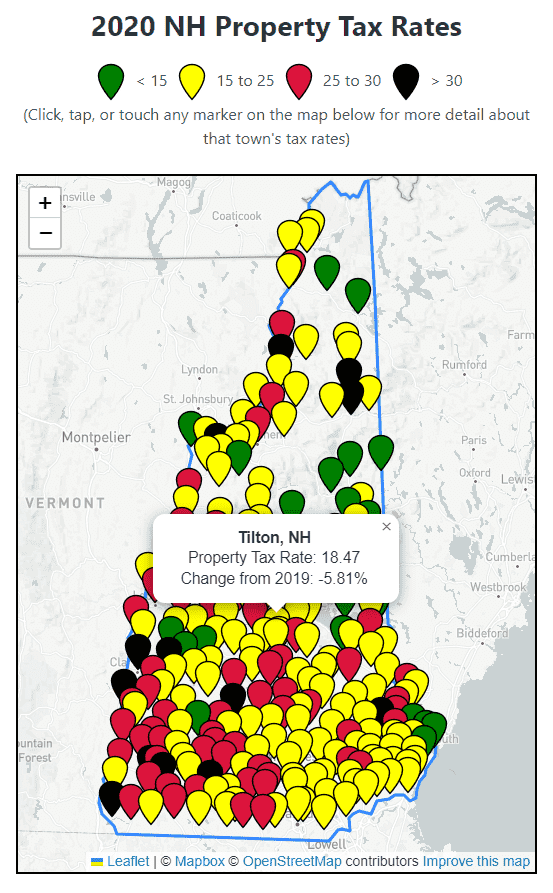

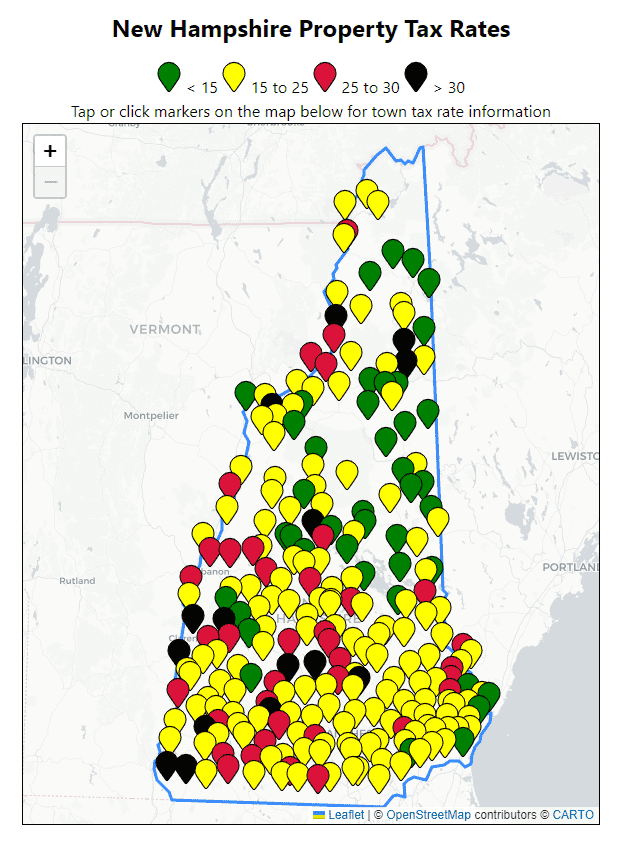

My Property Taxes Are What Understanding New Hampshire S Property Tax Milestone Financial Planning

New Hampshire Income Tax Nh State Tax Calculator Community Tax

New Hampshire Income Tax Nh State Tax Calculator Community Tax

New Hampshire Income Tax Nh State Tax Calculator Community Tax

Residential Taxpayer Resources Nashua Nh

All Current New Hampshire Property Tax Rates And Estimated Home Values

Property Tax Rates 2009 Vs 2020 R Newhampshire

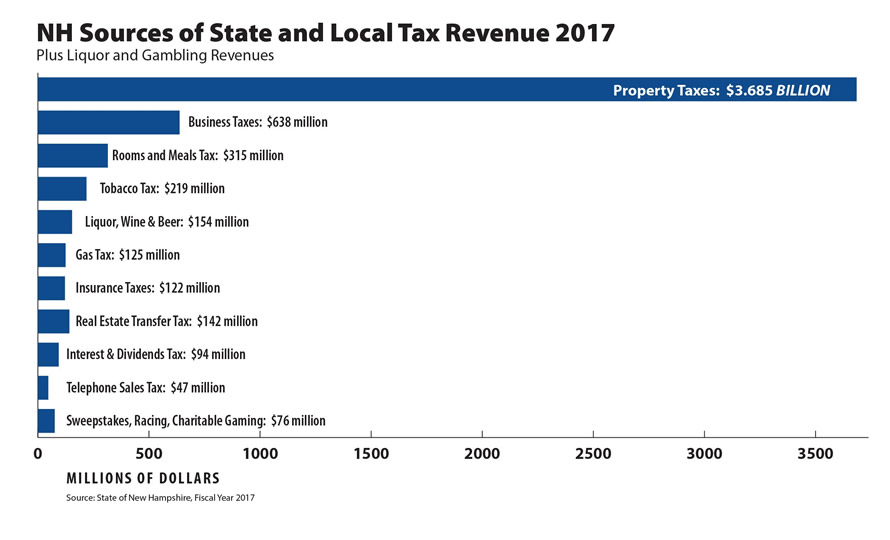

Axe The Property Tax Mark Fernald

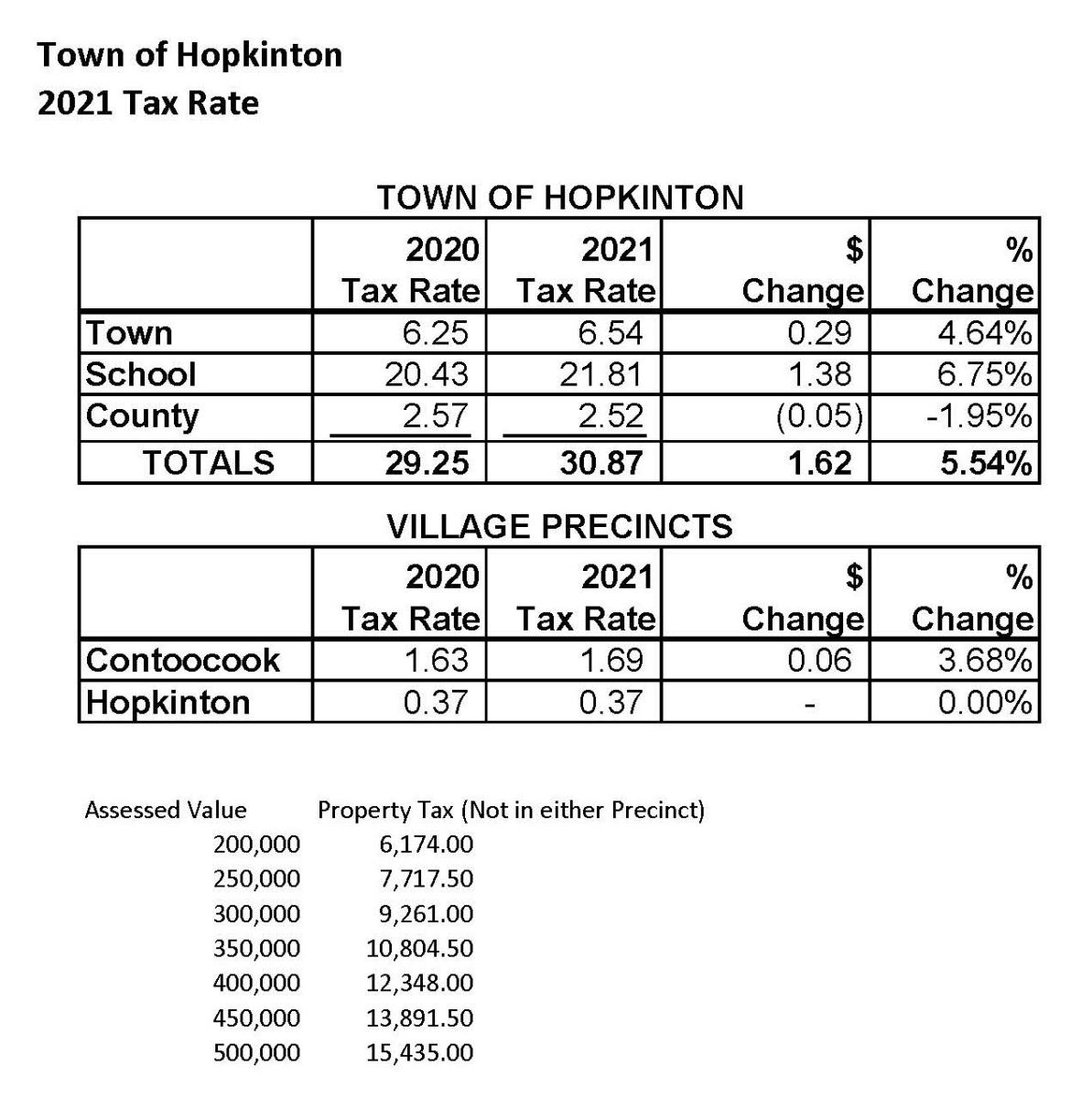

2021 Tax Rate Set Hopkinton Nh

New Hampshire Property Tax Calculator Smartasset

Business Nh Magazine Nh Named A Most Tax Friendly State

New Hampshire Income Tax Calculator Smartasset

New Hampshire Income Tax Nh State Tax Calculator Community Tax

Proposed New State Property Tax Formula Unveiled To Nh School Funding Commission Nh Business Review

Is New Hampshire Really As Anti Tax As It S Cracked Up To Be Stateimpact New Hampshire

New Hampshire Income Tax Nh State Tax Calculator Community Tax